How to Price Handmade Items: The Ultimate Guide

Learn step-by-step formulas and real-world tips on how to price handmade items for profit and growth.

Figuring out a price that covers your costs and makes sales is often one of the hardest parts of running a handmade craft business. If you set your price too low, you might be losing money by the time you factor in all costs of production, and if you wildly guesstimate a price you might be pricing yourself well out of the market.

Both situations are clearly ones you want to avoid!

In this blog post, we’ll cover how to price handmade items in a way that ensures you cover all costs of making your products, including your time, so you can be on your way to running a profitable business.

Ready to take your handmade business to the next level?

Try Craftybase: the award winning pricing software for makers that calculates accurate markups guaranteed to skyrocket your profit margins

The basic craft pricing formula

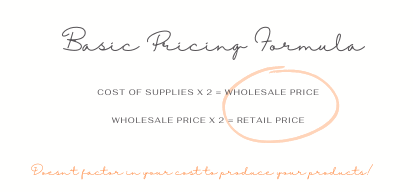

Let’s firstly cover the basic craft pricing formula that many Etsy sellers use.

The formula usually goes as follows:

Cost of your supplies x 2 = Your Wholesale Price

Your Wholesale Price x 2 = Your Retail Price

Now, you might be wondering what the difference is between wholesale and retail pricing. Wholesale pricing is what you would charge another business if they wanted to buy your product in bulk to sell in their store.

Retail pricing is what the consumer pays when they purchase the item from you directly. Retail pricing is typically lower than wholesale pricing, as the store that is buying in bulk can afford to sell at a lower margin than you as an individual artist.

It’s also worth noting that the 2x multiplier is just a general rule of thumb - some businesses use a 1.5x or even a 3x multiplier, depending on their particular cost of goods and how much profit they want to make per item.

Therefore, using the formula above, your wholesale price covers the cost of your materials and your time to make the product, whilst still giving you a 50% profit margin. And then when you sell the product at retail, you’re essentially doubling that profit margin so that you’re making 100% profit on the item.

However, there’s a couple of problems with this formula…

It doesn’t factor in your time

The profit margins might not be realistic

Let’s look at each of these points in turn.

1. How to factor in your time

The first issue with the basic pricing formula is that it doesn’t take into account how long it takes you to make the product. And as we all know, time is money! So how can you factor your time into the equation?

There are two ways to do this:

Use an hourly rate to price your products

Work out how long each product takes you to make and use that as a guide for pricing

Using an hourly rate

The first method is to calculate how much you want/need to earn per hour, and use that as a guide for how much to charge for each product.

To do this, you first need to figure out your monthly overhead costs. These are all the costs associated with running your business, such as:

Rent/mortgage

Utilities

Insurance

Business taxes

Advertising/marketing costs

Cost of goods sold (i.e. your materials)

Any other miscellaneous costs

Once you have all these figures to hand, you can calculate how much you need to earn each month to cover your costs. Let’s say, for example, that your monthly overhead costs are $2000. This means that you need to earn $2000 each month just to break even!

Now, let’s say that you want/need to take home a salary of $1000 per month from your business. This leaves you with a profit of $1000 for the month ($2000 - $1000).

To calculate how much you need to charge per hour to make this profit, you simply divide the profit by the number of hours you plan to work in the month. So, in our example above, if we wanted to work 20 hours per week (80 hours per month), we would do the following calculation:

1000 (profit) / 80 (hours) = $12.50 per hour

This means that, to make a profit and earn a salary of $1000 per month, you would need to charge at least $12.50 for each hour’s worth of work that went into making the product.

Now, you might be thinking that this hourly rate is too low. And you might be right! It all depends on how much you want/need to earn, and how many hours you plan to work each month. If you want/need to earn more money, you simply need to adjust your overhead costs accordingly, or increase the number of hours you plan to work each month.

Once you have your hourly rate figured out, you can use this to price all your products. Simply take the number of hours it took you to make the product, multiply it by your hourly rate, and that’s how much you should charge for the item!

For example, let’s say that you spend 2 hours making a pair of earrings. Using an hourly rate of $12.50, you would charge $25 for the earrings ((2 x 12.50) = 25).

Using time as a guide

The second method for factoring in your time is to work out how long each product takes you to make and use that information as a guide when pricing your products.

To do this, simply keep track of how long it takes you to make each product, either by timing yourself or keeping a tally of how long it takes you to make a certain number of items. Once you have this information, you can start to get an idea of how long it takes you to make each type of product on average.

You can then use this information to price your products accordingly. For example, let’s say that you’ve worked out that it takes you on average 30 minutes to make a pair of earrings. You could then charge $15 for the earrings (30 minutes x $0.50 per minute).

Of course, this method is only accurate if you’re able to work at a consistent pace and produce items that all take roughly the same amount of time to make. If your work is more erratic or if you produce a wide range of products that take different amounts of time to make, this method might not be suitable for you.

For more tips on how to calculate your hourly labor rate: How to calculate your handmade labor costs →

Ensuring you have realistic profit margins

The truth is, most businesses don’t make a huge profit. Many small businesses only make enough to cover their costs and provide a modest salary for the owner.

This is perfectly normal and nothing to be ashamed of! It’s important to remember that, when you’re starting out, your main goal should be to simply cover your costs and make enough money to keep the business going. Once you’ve established a solid customer base and built up a good reputation, you can start thinking about increasing your prices and making more of a profit.

So, what is a good profit margin for handmade items?

There’s no easy answer to this question as it depends on several factors, such as the type of product you’re selling, how much it costs you to make, how much competition there is, and how much people are willing to pay for your product.

Generally speaking, most businesses aim for a profit margin of around 8-30%. This means that, for every $100 worth of goods you sell, you should expect to make a profit of $8-$30.

Of course, this is just a general guide and your actual profit margins will vary depending on the factors mentioned above. For example, if you’re selling a high-end product with very little competition, you might be able to get away with a lower profit margin. Conversely, if you’re selling a low-cost product with lots of competition, you might need to aim for a higher profit margin to stay afloat.

Ultimately, it’s up to you to decide what profit margins you’re comfortable with. Just make sure that your prices are realistic and that you’re not selling yourself short!

A Better Handmade Pricing Formula

Now that you know what is wrong with the simple craft pricing formula above, we can start to expand it out to include the missing expenses that are eating unforeseen holes in your profit margins.

At a high level, the formula goes something like this:

(Base Manufacturing Cost x Markup)

+ Labor Costs

+ Overheads

+ Seller Fees

Product Price

As you can see, this pricing formula now allows for a couple of new (and really important) factors: your time to produce the product, your overheads and your fees to sell the product.

Your time to produce the product will result in an amount that you know you can pay yourself without cutting into your business profit margins.

Learn more about how to calculate your handmade labor costs →

You also have an additional markup now in place to cover your profits, which is applied to your Base Manufacturing Cost - the bonus here is that you know that your markup is directly going into your business profit as you have factored everything else into the equation here already.

Base Manufacturing Costs

Also known as the Base Production Cost, this is often guessed at by handmade sellers, however, getting this part accurate is one of the most important parts of the pricing calculation.

Knowing exactly how much it cost you to make the item puts you in a much better position as you will know the minimum possible price you can charge before you will make a loss on your product.

For your Base Manufacturing Cost, you’ll be trying to find out exactly how much it cost you to make a single quantity of your product.

For details on how to calculate your base cost, our blog post here will guide you through the steps with some handy examples: How do I calculate my product cost price?

Using software to calculate your product cost price

If the thought of calculating all these numbers yourself seems daunting, then good news - our software can do this for you!

Craftybase will automatically calculate how much each product costs to make as you add in your expenses and inventory movements. You’ll be able to see how much your products cost to make in real-time and adjust your prices accordingly.

What’s more, because all your financial data is in one place, you can run reports at any time to see how profitable each product is and how different price points will affect your business profit margins. Try Craftybase for free for 14 days.

Labor Costs

One of the biggest pricing mistakes Etsy sellers make is that they completely ignore their own labor costs when creating their retail prices. Being self-employed, it’s easy to undervalue or completely ignore the time you put into your business.

The improved Etsy pricing formula above factors this in to ensure that you remember to cover your wages outside of your business profits. The beauty of the formula is that you can either decide to include it as a separate amount or just factor it into your profit margins via the markup.

The formula you’ll want to use is:

Manufacture Time x Hourly Rate

Overheads

So what are “overheads”? They are essentially any business expenses that are not directly related to the creation of your products.

Some common examples of overheads are phone, electricity, rent, and machine maintenance - none of these costs can be connected with any of the products you make, so you consider them to be an “overhead” of running your business.

Overheads, business expenses and how to calculate them accurately deserve an article in their own right, so we have covered this in detail here: How to calculate overheads for your products →.

Seller Commission Fees

If you are selling on a marketplace like Etsy or Faire, or via a payment processor such as PayPal fees you’ll also need to factor in the costs that these platforms charge.

Due to the different services and payment structures that Etsy now offers, it can be difficult to get a full idea of the costs involved in selling your handmade item on Etsy.

Our blog post here will give you a detailed rundown of each Etsy fee and when it is applied: The Complete Guide to Etsy Fees →

Shipping costs

The final piece of the puzzle is shipping costs. The cost of packaging and shipping your product to your customer must also be factored into your retail price.

To accurately calculate how much it will cost you to ship a product, you’ll need to consider the cost of materials (e.g., boxes, bags, labels) as well as the actual postage costs.

It can be helpful to create a “shipping profile” in your accounting software for each type of product you sell (e.g., small items, large items, international shipping, etc.) which includes all of the associated costs. That way, when it comes to pricing a product, you can simply select the relevant shipping profile and the correct shipping costs will be factored in automatically.

If you need some help getting started with calculating your shipping costs, our blog post here will guide you through the process:

Calculating your desired markup

Markup is defined as the amount added to your cost price to arrive at a selling price and is a commonly used technique to use in determine how much to charge for your products.

The improved handmade pricing formula above factors in a markup that is applied to your base manufacturing cost.

Markup can typically be defined as a percentage – a markup of 100% would be cost price x 2, for example. The best way to illustrate how pricing markups work is via an example:

Jane makes a scarf and it costs her $29 in manufacturing costs (materials and labor). She would like to add a markup of 150% to arrive at her final selling price. Applying the markup percentage results in $72.50 as the suggested selling price ($29 × 2.5 = $72.50).

More techical details on pricing markups can be found in our post here: How to calculate pricing markups for your handmade items →

Putting it all together - an example pricing formula breakdown

Now that we’ve gone through all of the different elements that you need to consider when pricing your products, let’s put it all together with an example.

Say we are a jewelry maker who has just created a new necklace. We know that the item cost of materials is $10 and it takes us 1 hour to make the necklace from start to finish. Our hourly rate is $20 and we have estimated our overheads to be 10% of our total costs.

We’ve decided on a markup of 150% as we are selling retail.

We’ve also decided to include shipping costs in our retail price and, after doing some research, we estimate that it will cost us $3 to ship the necklace within the US. We are selling via Etsy, so have used an Etsy fee calculator to determine that we’ll be up for approx $3.60 in seller fees.

Putting all of this information into our handmade item product pricing formula, we get:

Base Manufacturing Cost = $10 (cost of materials) + $20 (manufacturing time)

Manufacturing Cost with Markup Applied = (Base Manufacturing Cost x 1.5) = $45

Retail price = $45 (manufacturing cost with markup) + $1.50 (overheads) + $3 (shipping) + $3.60 (seller fees)

Retail price = $53.10

And that’s how you price your products! By taking into account all of the different elements of your business costs, you can ensure that you are making a profit on each and every sale.

Do your market research!

Remember that the pricing formula is designed for you to figure out a safe pricing range for your products that ensures that you make a profit. From here, it’s up to you to research and compare to see what others are charging for the same types of products and tweak your markups where necessary.

Some questions to consider when evaluating your competitor’s products: what are they charging? Is your item better made or of better quality than theirs? You might be able to charge a premium over their price for this. Have you created something unique and different? This is another opportunity to sell your products at a higher rate.

Using software to calculate your prices

Once you’ve decided on a pricing strategy, you can use software to help you calculate your prices. Many software programs will help you calculate how much to charge for your products based on your costs, desired profit margin, and the competitive landscape.

If you’re comfortable using Excel, you can use it to help you calculate your prices. There are several formulas that you can use to help you determine your manufacturing cost, desired profit margin, and competitive landscape. You can find a lot of helpful resources online that will walk you through how to use Excel to price your products. It’s worth keeping in mind that this solution can quickly get unwieldy as your craft business grows.

Craftybase is an innovative software program designed for craft sellers that can help you calculate how much to charge for your products based on your actual costs and desired margins. You can use Craftybase to price your products based on your manufacturing cost, desired profit margin, and overheads. Try Craftybase for free today!

Experiment & Tweak

Don’t be afraid to experiment with your pricing - if you feel that it might be too high and your sales are slow, you can always adjust and see if sales pick up (just remember not to go under your Base Production Cost as you will be losing money on each sale!).

Likewise, if you notice that your prices are significantly under your competitors - try increasing them. Studies have shown that many people tend to equate quality with price and are thus prepared to pay more.

See our blog post here for other pricing tips and tricks you can try for your handmade item pricing: Handmade Pricing Psychology →

Adjusting your pricing

As your business grows and evolves, you might find that you need to adjust your prices. This could be for many reasons, such as:

You’re making more of a profit than you originally anticipated and want to increase your prices to reflect this.

The cost of materials or overhead costs has increased, so you need to raise your prices to cover these additional expenses.

You’re not making as much profit as you’d like, so you want to decrease your prices in order to make more sales.

Whatever the reason, it’s perfectly normal to adjust your prices over time. Just be sure to do it in a way that won’t alienate your existing customers to ensure you can still rely on repeat sales!

Conclusion

Pricing your products can be a tricky business, but it’s important to get it right if you want to be successful. By taking the time to figure out your costs, understand your target market, and find a pricing strategy that works for you, you’ll be well on your way to pricing your products correctly and making a profit.

We hope you found this guide to pricing your handmade items helpful, and if you have any questions please feel free to get in touch with us at Craftybase!