This Excel material tracking spreadsheet is designed to be a simple, periodic excel based system that will help you understand the fundamentals of material tracking and encourage good stock tracking habits.

To get started with the Material tracking spreadsheet, if you haven't already downloaded it, enter your email address above. This will send you an email with a link to download the spreadsheet as a zip file. Once unzipped, the spreadsheet can be opened and used in both Excel and Numbers for Mac.

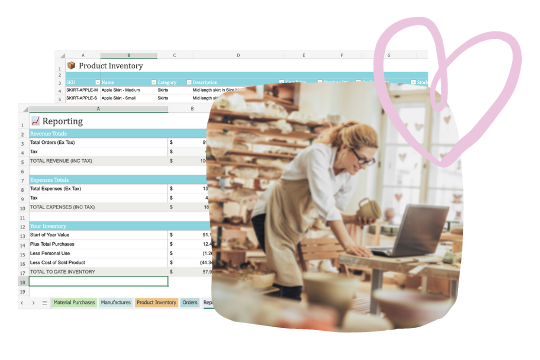

Once you have opened your materials spreadsheet in your spreadsheet program of choice, you'll see that it is divided into 7 tabbed sheets, each for a different area for tracking your inventory usage: Material Inventory, Personal Use, Purchases, Manufactures, Product Inventory, Orders and Reports.

The spreadsheet is designed to be used over the course of a single calendar year as it calculates your start and end of year inventory values. Once you have reached the end of the year, you'll want to create a new version for the next year, copy over your product and material tabs and then update stock levels and starting numbers.

Important note: Some columns are calculated and should not be edited - they are marked as a light turquoise color.

This sheet is for recording a complete inventory of your materials. The cost of these items are then factored into your estimated start of year inventory value*. You can also use this sheet to record your current stock of each material to see at a glance your stock status levels.

The sheet has 11 columns:

SKU This is an optional column for you to use if you have unique codes for each of your materials. [What is a SKU?](/blog/what-is-a-sku)

Name The name for your material that identifies it clearly (i.e. Blue Buttons 1.5")

Description A brief description of the material, used for identification purposes.

On Hand Qty This is the amount of this item you currently have on hand. You'll want to try and stocktake regularily to ensure that this number is as up to date as possible. [Learn about cycle counting](/blog/inventory-what-is-a-cycle-count)

Stock Status This is a calculated column that will show you at a glance which of your materials are in stock and which are out of stock.

Starting Quantity This is used for your start of year inventory valuation calculations. Enter the amount you had on hand of this material as of the start of the year (Jan 1). If you don't want to track your inventory valuation, you can leave this blank.

Unit Cost: This is the cost to purchase this material for a single tracking unit. You'll want to ensure that this is the fully landed material cost (which is a cost that includes shipping and discounts applied to the purchase order).

Starting Inventory Value This is a calculated column, do not edit. This is used to calculate your total inventory value for the material from your starting quantity and unit costs.

Tracking Unit You can use this column to describe how you are tracking the material so that it is clear how the unit cost is calculated. You'll want to generally use the unit you manufacture in to make your manufacture cost calculations easier. Examples of tracking units are sq inches, beads, cm, bottles.

Preferred Vendor A place to note the vendor you purchase this material from the most (detailed purchase history is logged under your Expenses tab).

This sheet is designed for logging all materials you have withdrawn from your inventory to use personally. It ensures that you are not claiming for materials you did not use directly in creating your products.

Date Removed The date you officially removed this stock from your inventory to use personally.

SKU The SKU for the material that has been removed.

Name The name of the material that has been removed from inventory.

Description A brief description of the material that has been removed from inventory.

Unit Cost The calculated unit cost (landed) for the material that has been removed. This is for a single tracking unit (i.e. bead, sq inch).

Quantity Used The total quantity removed from your inventory, tallied in the tracking unit you have defined for this material.

Total Cost The total cost of the material removed from inventory. This is a calculated column, do not edit.

This sheet is for logging the details of each of your material purchases so that you have a full record and can factor in the total you have bought during the year to your end of year inventory value.

You'll want to ensure that you create a new row for each material purchased - so if you have bought 5 different items from the same supplier, this would be entered as 5 rows in this sheet.

Purchase Date The date that the material was purchased.

SKU The SKU for the material.

Name The name of the material.

Description A brief description of the material, if SKU / Name is not enough to uniquely identify the material.

Vendor The company you purchased this material from.

Item Total Cost (ex Shipping, Tax) This is the total you paid for the item, not including any shipping, tax or discounts applied to the total expense (this gets included separately as a proportional amount).

Quantity Purchased How many tracking units of this material you purchased.

Shipping Cost (proportional) This is the proportional amount of shipping applied to the individual item. It can be calculated however you feel best suits the distribution of the shipping amount across the items in the order. For example, you might use relative cost or weight to determine this.

Tax (proportional) The calculated tax per material purchased. If this is not tallied directly per item in your expense, you'll want to again use a proportional calculation based on price to determine this amount.

Total Cost (inc Shipping) This is a calculated column, do not edit.

Unit Cost This is a calculated column, do not edit.

Landed Unit Cost This is a calculated column, do not edit.

This sheet is designed for you to record the creation of any products you make so you can track your material usage and costs.

You can either create a new row for each material you have used to create the product so that you can calculate total material usage for each, or calculate the total outside of the spreadsheet and enter a single row for the whole manufacture.

Manufacture Date The date on which you created the product.

Product SKU The SKU of the product created.

Product Name The name of the product created.

Material SKU The SKU of the material used to create the product.

Material Name The name of the material used to create the product.

Unit Cost The cost for the material in your chosen tracking unit (i.e. sq inch, bead, ounce)

Quantity Used The total quantity of tracking units consumed of this material. This is the amount you'll want to decrease your stock on hand by over on your Materials Inventory tab.

Total Material Usage Cost This is a calculated column, do not edit.

This sheet is for recording a complete inventory of your products. The cost of these items are factored into your estimated start of year inventory value*. You can also use this sheet to record your current stock of each product to see at a glance stock status levels.

SKU The SKU for your product.

Name The name of your product.

Category The category for your product, if you wish to track categories.

Description A brief description of your product.

Unit Price The retail price that you charge for a single quantity of this product.

Starting Quantity This is used for your start of year inventory valuation calculations. Enter the amount you had on hand of this product as of the start of the year. If you don't want to track inventory valuation, you can leave this blank.

On Hand Qty This is the amount of this item you currently have on hand. You'll want to try and stocktake regularily to ensure that this number is as up to date as possible.

Stock Status This is a calculated column that will show you at a glance which of your materials are in stock and which are out of stock. Do not edit.

Manufacture Cost The cost of materials to create a single unit of this product. You can use the manufacture sheet in order to tally this number.

Starting Inventory Value This is a calcuated column, do not edit.

Current Inventory Value This is the current value of your product stock. Calculated column - do not edit.

This sheet allows you to record all sales of your products. Recording the estimated material manufacture cost for each will help you in tallying your COGS for the year.

Each product sold should be created as a seperate row in this sheet so that manufactures and unit costs can be tallied for each.

Order Date The date that the order was placed.

Order ID Your unique identifier for the order.

SKU: The product SKU sold.

Name The name of the product sold.

Unit Price How much the product was sold for per item, not including shipping.

Quantity Sold The total quantity sold of the product.

Unit Manufacture Cost The estimated manufacture cost for this product per unit.

Total Manufacture Cost The total manufacture cost of all quantities ordered. Calculated column - do not edit.

Total Price The total price for all quantities of the product ordered. Calculated column - do not edit.

Tax The proportional amount of tax applied to this item in the order. This is best calculated based on the item total.

Shipping The proportional amount of shipping applied to the item in the order. This is best calculated as either the price or the individual weight of the item.

Grand Total The grand total for this line item of your order. Calculated column - do not edit.

This sheet tallies up the important revenue, expense and inventory tallies you'll want to be tracking through the year. All tallies are calculated - do not edit.

*All inventory calculations in the spreadsheet are based on your own material unit cost calculations made during the year, so you'll want to ensure that they are as accurate as possible.

An Material Tracking Spreadsheet is a pre-designed document that allows sellers of manufactured goods to keep track of their inventory. It typically includes fields for product name, description, quantity, price, and any other relevant information about the item. This template can be used by individual sellers or small businesses who create and sell their own products.

1. Organize your material inventory

Keeping track of materials and product inventory can be overwhelming, especially for small businesses who often have a wide variety of products. Using an inventory template allows you to keep all your product information in one place and easily update it as needed.

2. Track sales and profits

With an inventory template, you can also record sales and calculate profits for each item. This information can be used to analyze which products are selling well and which ones may need adjustments or promotion.

3. By regularly updating your inventory template with sold items, you can easily see when it's time to restock on popular products. This helps prevent stock shortages and ensures that your customers will have access to their favorite items.Plan for restocking

By regularly updating your inventory template with sold items, you can easily see when it's time to restock on popular products. This helps prevent stock shortages and ensures that your customers will have access to their favorite items.

4. Streamline tax preparation

For small businesses, keeping track of inventory is essential for tax purposes. An inventory template allows you to easily see your total product costs, sales, and profits, making tax preparation much simpler.

While Excel spreadsheets can be a useful tool for managing inventory and tracking COGS, they may not always be the best choice for businesses. Here are some reasons why:

Limited functionality: Excel is designed primarily for data manipulation and does not have the advanced features of specialized inventory management software. This means that it may not be able to handle complex inventory calculations or generate detailed reports.

Prone to errors: Manual data entry and calculations in Excel can be prone to human error, which can lead to discrepancies and inaccuracies in inventory and COGS information.

Difficulty with scaling: As businesses grow and their inventory becomes more complex, managing it solely through an Excel spreadsheet may become more challenging. It may not be able to handle large amounts of data or multiple inventory locations efficiently.

Lack of integrations: Excel may not integrate with other systems and software used in a business, making it difficult to streamline processes and share information across departments.

In conclusion, while Excel spreadsheets may be suitable for small businesses with simple inventory needs, as a company grows, it is often necessary to invest in more robust inventory management software to effectively manage inventory and COGS. This can help businesses streamline processes, reduce errors, and make informed decisions based on accurate data. So, it is important for businesses to evaluate their current and future needs before deciding on an inventory and COGS management solution.

Say hello to Craftybase, your new material inventory software. Craftybase provides advanced features that outshine those offered by traditional spreadsheets. This software is designed to mitigate human errors, efficiently manage complex material inventory, and effortlessly scale with your growing business. Plus, Craftybase seamlessly integrates with your existing ecommerce systems (like Shopify, WooCommerce, Square, Etsy and more).

R

Ready to revolutionize how you manage inventory and COGS? Take advantage of our Free Trial and experience the difference today.