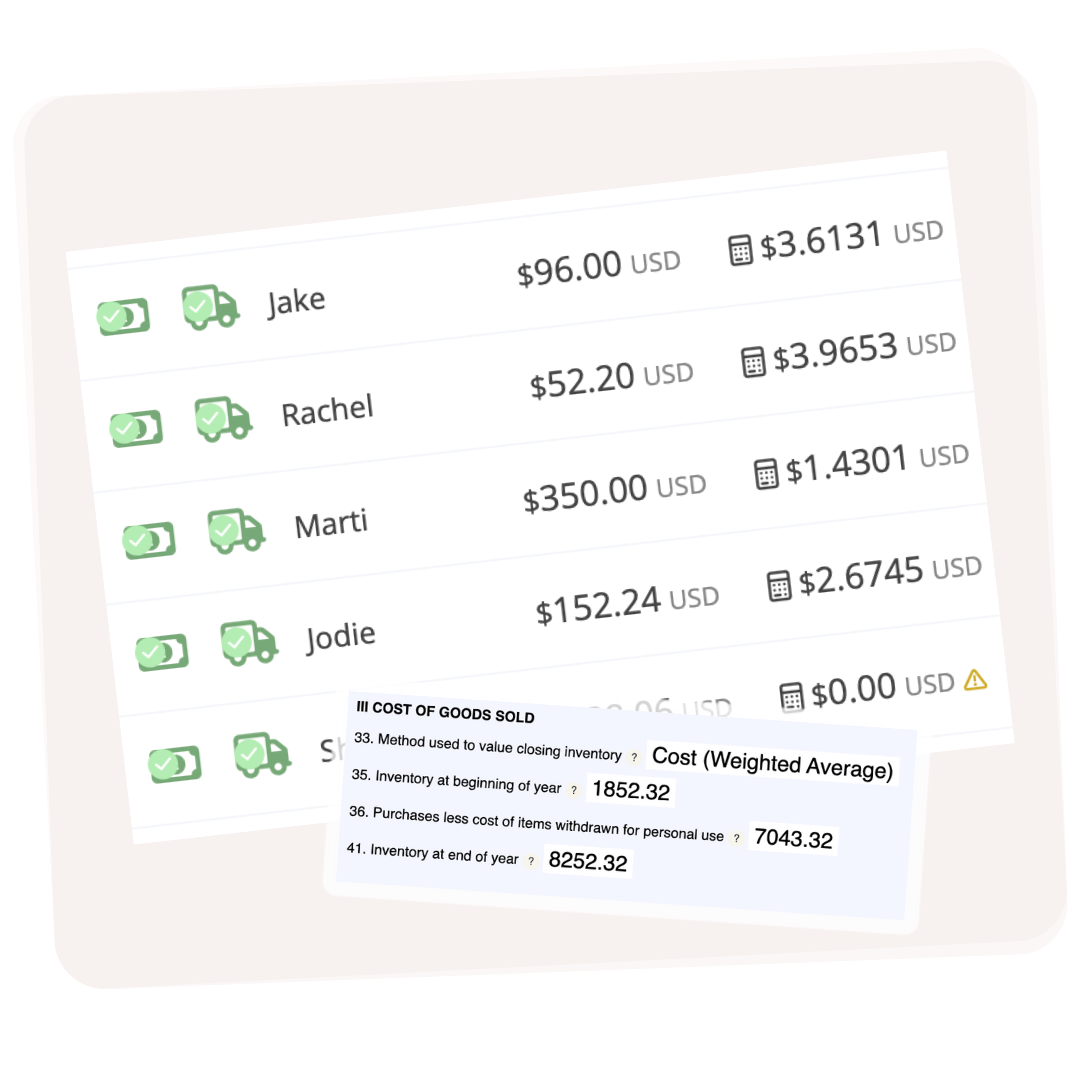

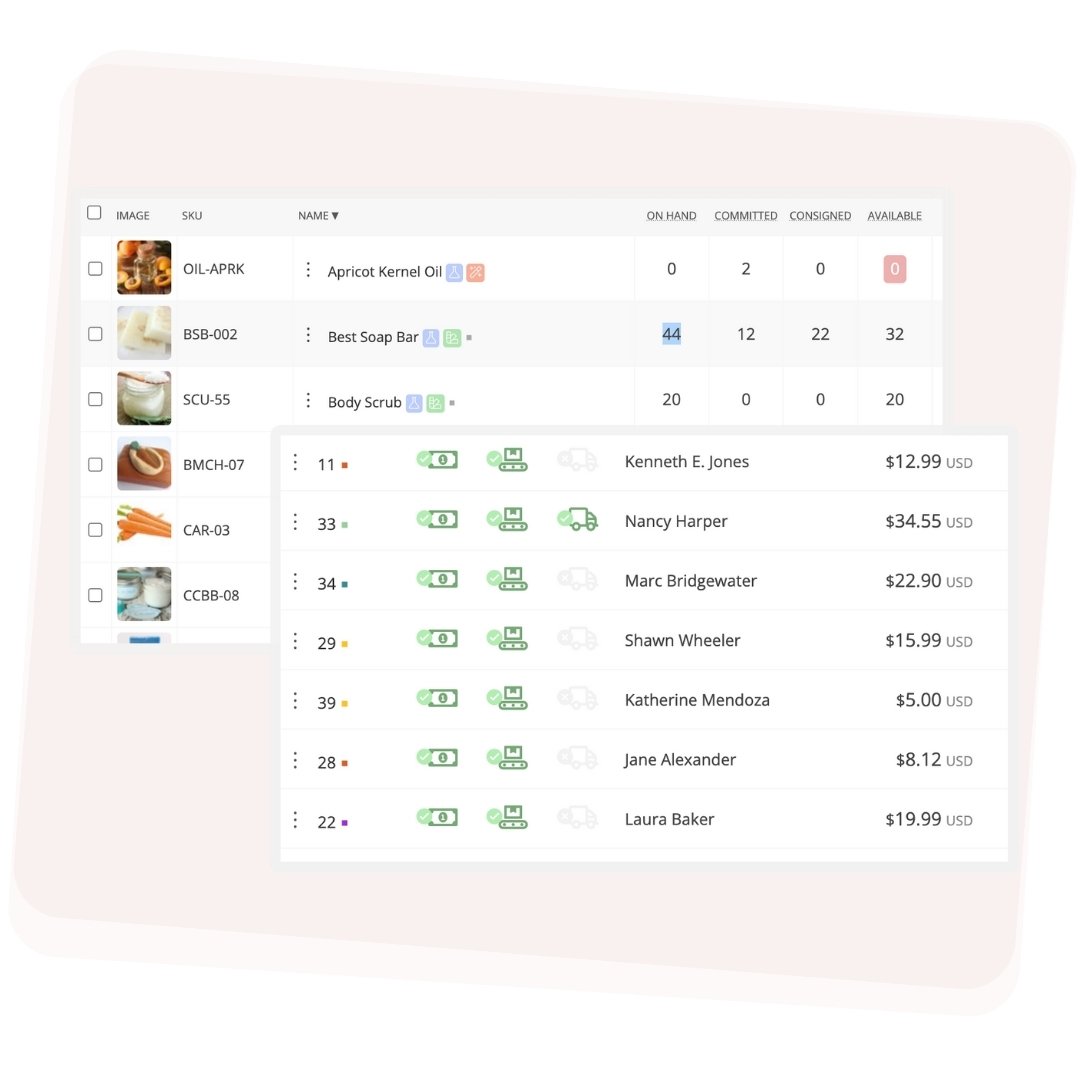

Cost of Goods Sold (COGS) Software

COGS tracking built for how you make

If you're still calculating COGS in spreadsheets at tax time, you're working harder than you need to. Craftybase tracks your material costs, labor, and overhead as you go — so your Cost of Goods Sold is always accurate and ready when you need it.

*no credit card required